The relationship between banking, fintech and the Titanic

The relationship between innovation and regulation

I hesitate to write this, as it is controversial. But then I am not afraid to confront controversy.

After the tragic implosion of Titan, the OceanGate submersible submarine that was doing the deep dive to the Titanic ...

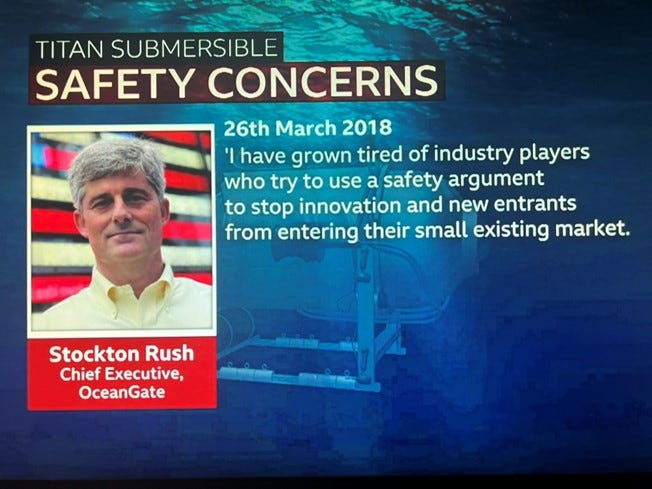

... emails came to light where the founder of OceanGate, Stockton Rush, flagrantly disregarded warnings that the submarine could fail. Bear in mind that OceanGate is the company that operated the disastrous mission that failed.

One of the main exchanges was between Stockton Rush and Rob McCallum, founder of Eyos Expeditions. In this email exchange, you can see the core of the discussion.

Rob McCallum, a divemaster who has led multiple expeditions to the Titanic warned Rush in 2018 about the safety of the Titan submersible, telling the CEO he was putting himself and his clients in danger. McCallum is a member of the Marine Technology Society, a group of industry leaders in the submersible industry, and signed a 2018 letter from the group to Rush, expressing concern over the company’s “experimental approach” of its planned expedition to the Titanic wreckage.

“As much as I appreciate entrepreneurship and innovation, you are potentially putting an entire industry at risk,” McCallum wrote. “I implore you to take every care in your testing and sea trials and to be very, very conservative.”

Rush responded days later, saying his company’s “engineering focused, innovative approach, flies in the face of the submersible orthodoxy, but that is the nature of innovation.”

McCallum pressed Rush again, writing, “I have given everyone the same honest advice which is that until a sub is classed, tested and proven, it should not be used for commercial deep dive operations.”

There have been other revelations since, such as Rush saying that safety is a waste of time and a cost overhead.

The whole exchange made me come back to my comfort zone, fintech, and reminded me of the many conversations I’ve had with start-ups and challengers, telling them that they need to be regulated to have credibility and trust.

In fact, more importantly, the exchange between McCallum and Rush made me think of Revolut, N26, Monzo, RobinHood and more, who have all been slapped with regulatory restrictions due to their allegedly lacklustre onboarding processes and internal checks. There are many more. For example, around $10 billion was the bill for KYC and identity fines collected by regulators in 2022 which, to put in context, compares with $26 billion for the entire post-financial crisis decade of 2008-2018. Those fines are not purely for fintech firms, but for banks and fintechs and, just to point this out, many banks fail at KYC too.

The thing is that there are industries where fail fast and innovate work well. Retail, technology and others may be able to get away with it. Then there are industries where fail fast and innovate work badly. These are industries where failure could cause loss, suicide or death. Airlines, pharma and banking being a case in point. Lose your life savings and jump off a bridge? Aeroplane engines unchecked and crashed? Life saving drug that caused death? These are all markets that demand tightly regulated checks and balances.

And this is why the exchange between Rush and McCallum hit home hard for me, because some fintechs claim that banking is boring and needs an overhaul. I agree. But what overhaul? Not one that allows the opening of unintended consequences or excessive risk. This is where Rush and McCallum disagreed.

Rush wanted to innovate and fail fast; McCallum was arguing that you need to be tested and certified. What do you think?